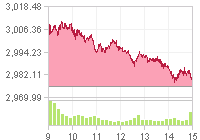

KOSPI May Hit New Historical High

Updated July 13, 2005

The Korean stock market is expected to maintain its momentum to reach a new historical high this year on ample liquidity, solid corporate earnings and strong exports, a head of an international equity fund said.

``The Korea Composite Stock Price Index (KOSPI) will hit an all-time high this year boosted by a series of positives, including a rebounding dollar and rising equity liquidity,’’ Henry Seggerman, CEO of New York-based International Investment Advisors (IIA), said in an interview with The Korea Times yesterday.

IIA established Korea International Fund in 1992, the oldest hedge fund invested in the Korean stock market, which manages a $75 million equity investment focusing mainly on small cap companies, retail stocks and Kosdaq-listed firms.

``Continued shifts of asset allocations by domestic investors toward equities, evidenced by rapid growth in equity-type installment funds, will help drive the stock index higher in the second half. Institutional investors, including the National Pension Fund, are also expected to buy an increasing amount of stocks,’’ he noted.

Seggerman added that export-oriented blue chip stocks such as Samsung Electronics would benefit from a marked pick-up in the U.S. consumer sentiment and growth rate, mitigating a recent decline in Korean exports bound for the world’s largest economy.

``I expect the KOSPI index to reach even the 2,000 point mark if the National Pension Fund invests 40 percent of its total investment assets in the stock market with households raising the equity investment ratio to 15 percent,’’ he said.

Touching on the country’s risk involving North Korea along with other negative corporate governance factors, also known as the ``Korea discount,’’ Seggerman said that it is absolutely mischaracterized and overblown.

``There has been no correlation between the KOSPI index and a series of negative developments involving the communist state’s controversial nuclear weapons program over the past two years. The stock market actually rose when any new developments hit the market,’’ he said.

``Domestic institutional and retail investors’ negative perception of the stock market is a main factor behind the Korea discount. They view the market as a high-risk gambling place similar to casinos,’’ Seggerman said, adding that such perception will change soon.

He also predicted that the stock market will not be significantly affected by a series of U.S. rate hikes as foreign equity investors would continue to remain active here.

Saggerman discounted the possibility that the probable rate reversal between U.S. and Korean short-term interest rates could cause massive flows of capital out of Korea into U.S. financial markets.

``U.S. rate hikes are not likely to encourage foreign investors to shift to dollar-based assets. International fixed-income and equity markets are less correlated to the U.S. interest rates,’’ he said.

On June 30, Federal Reserve Board (FRB) chairman Alan Greenspan and his colleagues, sticking to a course of gradually raising rates, hiked the key rate by one quarter of a percentage point to 3.25 percent, matching Korea’s call rate.

But the Bank of Korea kept its target call rate at a record-low of 3.25 percent for the eighth consecutive month last Thursday to help bolster sluggish domestic consumption and investment.

Seggerman forecast that the FRB will not raise the key rates by more than 0.5 percentage point in the future due to concerns about its potential negative impact on U.S. consumption.

``Fed rate hikes are expected to have only limited effects on Korea’s exports to the U.S. because a stronger dollar will make Korean products more price-competitive, while the U.S. consumption will not likely slow, being able to withstand rate hikes,’’ he said.

Regarding the recent surge in apartment prices, Seggerman said that the government’s price control measures will further distort the housing market mechanism, resulting in even higher apartment prices in southern Seoul and its vicinities.

``The only solution to stabilizing the housing market is to supply more houses in which people want to live,’’ he said, adding that the idea of overpriced apartment is incorrect because it is still relatively cheaper compared to that of other Asian cities.

Touching on the recent negative foreign media coverage of the Korean government’s policies to regulate foreign equity funds, Seggerman said that every country has the right to form appropriate polices suited to their unique local circumstances.

``All countries have a lot of unreasonable protectionist policies, including the U.S. It is unfair to single out and brand Korea as anti-foreign,’’ he said.

[Source: Korea Times (July 13, 2005)]

``The Korea Composite Stock Price Index (KOSPI) will hit an all-time high this year boosted by a series of positives, including a rebounding dollar and rising equity liquidity,’’ Henry Seggerman, CEO of New York-based International Investment Advisors (IIA), said in an interview with The Korea Times yesterday.

IIA established Korea International Fund in 1992, the oldest hedge fund invested in the Korean stock market, which manages a $75 million equity investment focusing mainly on small cap companies, retail stocks and Kosdaq-listed firms.

``Continued shifts of asset allocations by domestic investors toward equities, evidenced by rapid growth in equity-type installment funds, will help drive the stock index higher in the second half. Institutional investors, including the National Pension Fund, are also expected to buy an increasing amount of stocks,’’ he noted.

Seggerman added that export-oriented blue chip stocks such as Samsung Electronics would benefit from a marked pick-up in the U.S. consumer sentiment and growth rate, mitigating a recent decline in Korean exports bound for the world’s largest economy.

``I expect the KOSPI index to reach even the 2,000 point mark if the National Pension Fund invests 40 percent of its total investment assets in the stock market with households raising the equity investment ratio to 15 percent,’’ he said.

Touching on the country’s risk involving North Korea along with other negative corporate governance factors, also known as the ``Korea discount,’’ Seggerman said that it is absolutely mischaracterized and overblown.

``There has been no correlation between the KOSPI index and a series of negative developments involving the communist state’s controversial nuclear weapons program over the past two years. The stock market actually rose when any new developments hit the market,’’ he said.

``Domestic institutional and retail investors’ negative perception of the stock market is a main factor behind the Korea discount. They view the market as a high-risk gambling place similar to casinos,’’ Seggerman said, adding that such perception will change soon.

He also predicted that the stock market will not be significantly affected by a series of U.S. rate hikes as foreign equity investors would continue to remain active here.

Saggerman discounted the possibility that the probable rate reversal between U.S. and Korean short-term interest rates could cause massive flows of capital out of Korea into U.S. financial markets.

``U.S. rate hikes are not likely to encourage foreign investors to shift to dollar-based assets. International fixed-income and equity markets are less correlated to the U.S. interest rates,’’ he said.

On June 30, Federal Reserve Board (FRB) chairman Alan Greenspan and his colleagues, sticking to a course of gradually raising rates, hiked the key rate by one quarter of a percentage point to 3.25 percent, matching Korea’s call rate.

But the Bank of Korea kept its target call rate at a record-low of 3.25 percent for the eighth consecutive month last Thursday to help bolster sluggish domestic consumption and investment.

Seggerman forecast that the FRB will not raise the key rates by more than 0.5 percentage point in the future due to concerns about its potential negative impact on U.S. consumption.

``Fed rate hikes are expected to have only limited effects on Korea’s exports to the U.S. because a stronger dollar will make Korean products more price-competitive, while the U.S. consumption will not likely slow, being able to withstand rate hikes,’’ he said.

Regarding the recent surge in apartment prices, Seggerman said that the government’s price control measures will further distort the housing market mechanism, resulting in even higher apartment prices in southern Seoul and its vicinities.

``The only solution to stabilizing the housing market is to supply more houses in which people want to live,’’ he said, adding that the idea of overpriced apartment is incorrect because it is still relatively cheaper compared to that of other Asian cities.

Touching on the recent negative foreign media coverage of the Korean government’s policies to regulate foreign equity funds, Seggerman said that every country has the right to form appropriate polices suited to their unique local circumstances.

``All countries have a lot of unreasonable protectionist policies, including the U.S. It is unfair to single out and brand Korea as anti-foreign,’’ he said.

[Source: Korea Times (July 13, 2005)]

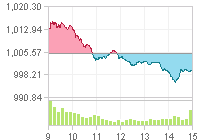

Global Index

|

4.30

|

0.00%p

|

1,132.00

|

| Dollar/Won | KTB3Y | Oil(WTI) |

| 1,132.00 | 1.19% | 38.56 |

Global Market

| 27,685.38 | -650.19 | 2.29% | |

| 3,400.97 | -64.42 | 1.86% | |

| 11,358.94 | -189.34 | 1.64% | |

| 23,304.29 | -190.05 | 0.81% | |

| 24,918.78 | +132.65 | 0.54% | |

| 3,251.12 | -26.88 | 0.82% |